21 Steps to a Completed Canada Customs Invoice

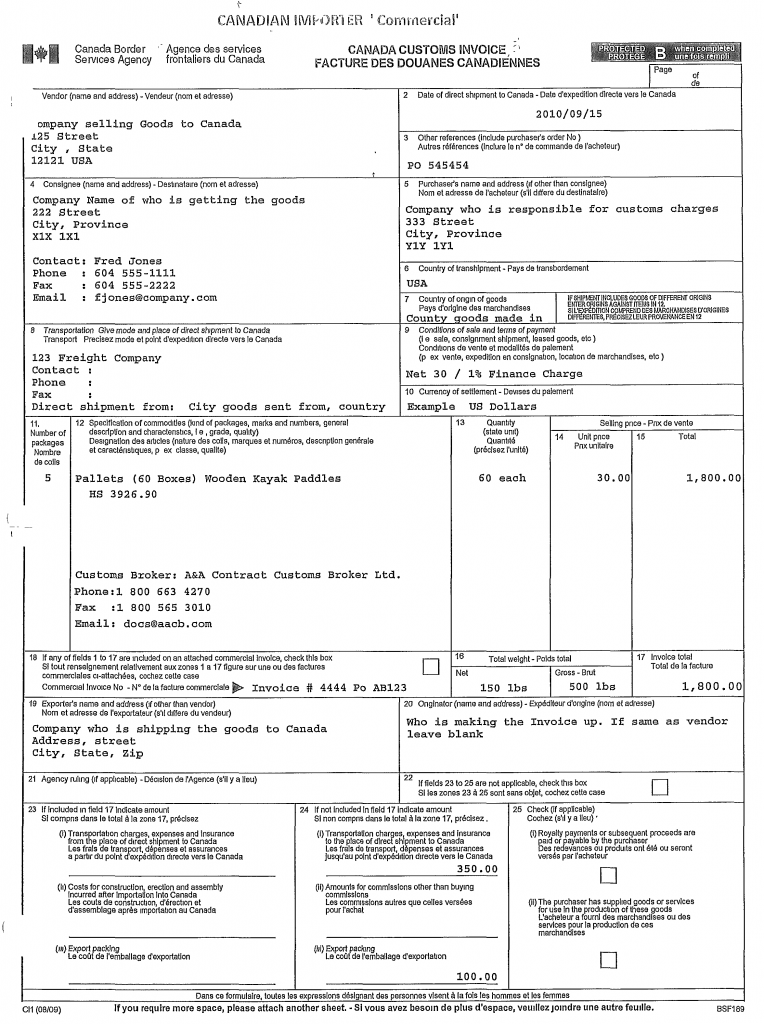

We’ve made it incredibly easy for you to complete the Canada Customs Invoice in 21 steps. Here is a screenshot of a sample completed invoice:

Below is a full description of how to complete each required field on Form CI1, Canada Customs Invoice, or a commercial invoice.

Create a Canada Customs Invoice using our Free online template.

1. Vendor

– (seller, sold by, remit to, consignor, shipper) – Indicate the complete name, including the company name if applicable, and address (street, city, location) of:

(a) the party selling the goods to the purchaser; and/or

(b) the party consigning the goods to Canada.

2. Date of direct shipment to Canada

– Indicate the date the goods began their continuous journey to Canada.

3. Other references

– Use to record other useful information (e.g., the commercial invoice number, the purchaser’s order number).

4. Consignee

– The name and address of the party to which the goods are being “shipped to” as shown on the commercial sales contract (i.e. commercial invoice, bill of sale, or other sales contract).

5. Purchaser’s name and address – (sold to, buyer)

– The last known entity to whom the merchandise is sold leased or otherwise transacted.

6. Country of transshipment

– The country through which the goods were shipped in transit to Canada under customs control.

7. Country of origin of goods

– The country of origin of invoiced goods is the country in which the goods have been grown, produced, or manufactured according to criteria laid down for the application of the Customs Tariff or quantitative restrictions, or any measure related to trade. Each manufactured article on the invoice must have been significantly transformed in the country specified as the country of origin to its present form ready for export to Canada. Certain operations such as packaging, splitting, and sorting may not be considered as sufficient operations to confer origin.

Note: The origin of goods as applied to the assignment of tariff treatment is dealt with in Memorandum D11-4-2, Proof of Origin.

8. Transportation: Give the mode and place of direct shipment to Canada

– Indicate the mode of transportation and the place from which the goods began their uninterrupted journey to Canada.

9. Conditions of sale and terms of payment

– Describe the terms and conditions agreed upon by the vendor and the purchaser.

10. Currency of settlement

– Indicate the currency in which the vendor’s demand for payment is made.

11. Number of packages

– Indicate the number of packages.

12. Specification of commodities

– The following information must be provided:

(a) Kind of packages – Indicate the kind of packages (e.g., cases, cartons).

(b) Marks and numbers – Indicate the descriptive marks and numbers imprinted on the packaged goods. The marks and numbers must be legibly placed on the outside of all packaged goods if possible. However, the following classes of shipments do not require marks and numbers:

(1) shipments forwarded by parcel post;

(2) goods shipped in bulk, that are not packaged, but merely wire-bound, tagged or fastened together in lots. However, the number of pieces, bundles, bushels, etc., must be shown on the invoice; and

(3) agricultural equipment and machinery, or machinery parts, when shipped loose. However, when in packages, the invoices must show the numbers and descriptions of the same.

(c) General description and characteristics – Give, in general terms, a description of the merchandise (e.g., textiles, auto parts, live goldfish, fresh Chilean seabass) and show a proper identifying description in commercial terms (i.e., style or code numbers, size, and dimensions) as known in the country of production or exportation. For plants and animals and their products and derivatives, also indicate the scientific name of each species (e.g., Carassius auratus, Dissostichus eleginoides).

Create a Canada Customs Invoice using our Free online template.

The condition of the goods, if other than new, must be given on the invoice, and, if applicable, the following information shown:

(1) other than prime quality goods;

(2) remnants;

(3) job lots;

(4) close-outs;

(5) discontinued lines;

(6) obsolete goods; and

(7) used goods.

13. Quantity

– Indicate the quantity of each item included in the description field in the appropriate unit of measure.

14. Unit price – (price per article, item amount)

– Provide a value in the currency of settlement (as defined under Field 10) for each item described in the description field.

15. Total

– Indicate the price paid or payable in the currency of settlement (as defined under Field 10) for the number of items recorded in the quantity field when they were sold by the vendor to the purchaser. Where there is no price paid or payable for the items recorded in the description field, N/A should be indicated.

16. Total weight

– Show both net and gross weight.

17. Invoice total – (total value, pay this amount)

– The total price paid or payable for goods described on the invoice or on the continuation sheet if used.

18. Self-Explanatory.

19. Exporter’s name and address

– Indicate the name and address of the person or organization shipping the goods to the consignee/purchaser.

20. Originator

– Where the invoice is completed on behalf of a company, the company’s name and address must be indicated. The name of the person completing the invoice may also be indicated. Invoices completed on behalf of individuals must indicate the name and address of the person completing the invoice. This field may be left blank if this information is provided elsewhere on the invoice.

21. CBSA ruling

– Give the number and date of any CBSA ruling applicable to the shipment.

22-25. Indicate the currency used when Field 23 or 24 is applicable.

The actual completion of Fields 22 to 25 is self-explanatory with the exception of export packing. The amount of export packing must be indicated if additional packing was required solely for the overseas transportation of goods. Detailed information on the remaining sub-components of these fields can be found in Memorandum D13-4-7, Adjustments to the Price Paid or Payable (Customs Act, Section 48).

Create a Canada Customs Invoice using our Free online template.