You can’t say Canada or America without A & A, eh?

Today we’re giving you some guidance on how to fill out a CCI/Commercial Invoice/Certificate of Origin-FTAs. These are essential, and often filled out incorrectly. Proper, complete documentation on Importers of Record (IOR) is vital to ensuring your importing and exporting process is free from setbacks so your shipments sail through customs. We’ve put together some tips on how you can manage your paperwork, and as always, our expert A & A team members are here to help, anytime.

In the interest of creating clarity, we’re divvying up the different documents needed to import into Canada, and into the USA. We’ll start with Canada. The two countries share borders and some paperwork similarities, but the differences are essential to understand, and to follow to the letter.

Shedding some Northern Light into Importing into Canada

Before you can do anything else, you’ll need to obtain a Business Number (BN) from the Canada Revenue Agency (CRA). It’s free to create for import/export purposes and is usually available within a few minutes. You can call 1-800-959-5525 or you can do it online, here.

We (and the CBSA) recommend that you employ a customs broker to manage your importing/exporting business, due in part to the large number of forms and pieces of essential paperwork that to a customs broker are almost second nature, but for the average business owner, they can be daunting. The CBSA has a list of registered brokers, here. You’ll see that A & A is registered for business across Canada, and while it’s not listed on the CBSA website, we do have over 30 years of experience in perfecting importing into Canada.

Moving on!

Designating the country of origin from where the goods are imported is the next paper-trail-intensive step. You must include the country of origin and as many details about the final product or products as possible. You must also ensure that the products you wish to import are not legally prohibited in Canada – a list of those products is here. Some are common sense, some may surprise you. So know before you try and import!

There is a difference between prohibited and restricted products, so you may be allowed to bring products in, but they may carry their own sets of restrictions and paperwork.

CODE we get to the paperwork for the most BASIC importing? Not yet?

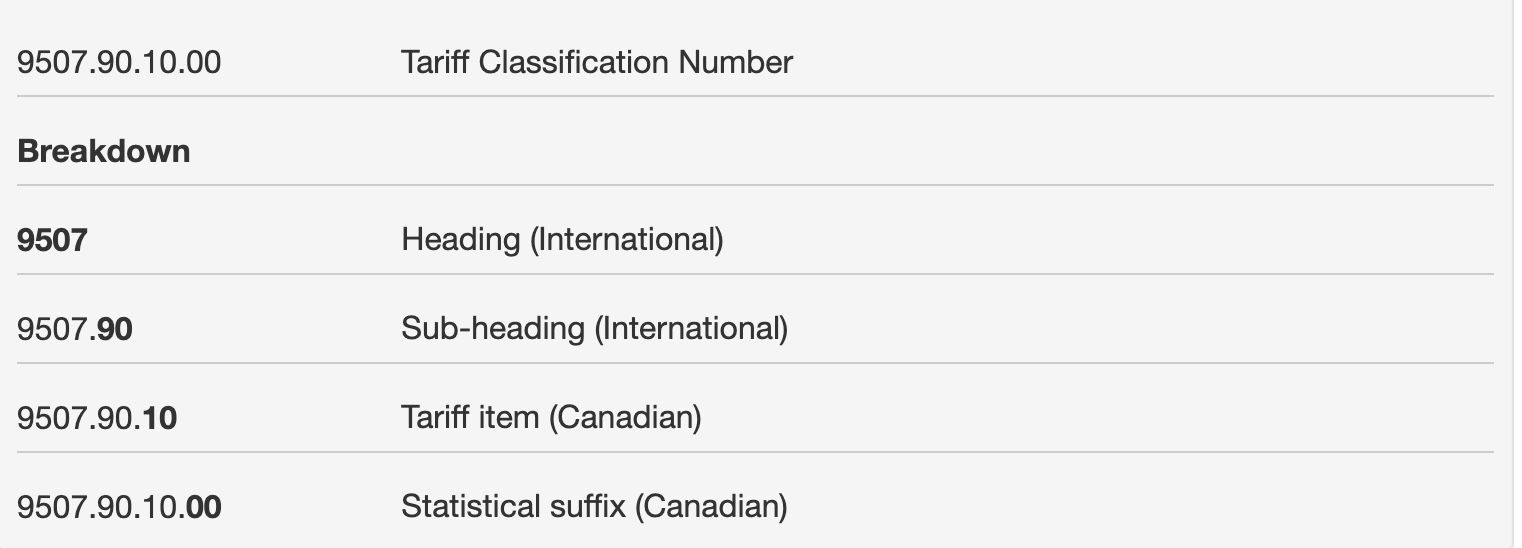

Codes – oh good. Not to fear, Canada is one of the countries that observes the Harmonized

System (HS), like most trading countries. There’s still a lot to remember, pictured below.

We often have to contact Importers of Record (IORs) or vendors due to missing information. Shipments missing information may experience delays which will lead to extra costs to the carrier. Ensuring all of your required information is completed, and accurate is vital to avoid frustrating and costly delays. Goods must be classified to the HS so that the rules of origin can be properly applied, as each tariff treatment is linked to certain rules of origin.

Essential paperwork: CCI (Canada Customs Invoice) or a Commercial Invoice: Not the Same!

A customs invoice is not a commercial invoice for large-scale freight importers and exporters. Instead, a customs invoice is used as a stand-in for a commercial invoice. It allows a shipment to clear customs without being a final request for payment.

This form is used for importers paying the seller for the goods, and for the exporter to collect payment from the buyer. You will need 2 copies of the CCI (Canadian Customs Invoice).

- 1 is attached to the shipment to present at customs

- 2 is attached to the bill of lading

When deciding if you can use a CCI or a Commercial Invoice, you can use a Commercial Invoice in place of a CCI as long as you include the following information via the CB Institute:

- The exporter’s full name, address and country

- The importer’s full name and address

- A detailed description of the goods in the shipment

- Net and gross weight

- Unit price of each item (using the currency of settlement)

- Currency used for payment of the goods

- The agreed upon terms of delivery and payment

- The date the goods went in transit

- Reference numbers (purchaser’s order number)

- Import license (if applicable)

- Freight charges/insurance

The CCI can be filled out by the exporter, importer or their agents (so long as the exporter provides all of the information required). This is a great time to lean on industry experts, like our team at A & A.

Certificate of Origin-FTAs (needed for both Canada and the USA)

There are many different tariff treatments and many nuances within the Free Trade Agreement. Certificate of origin forms are used for claims for preferential treatment tariffs required by the Free Trade Agreement (FTA). These are heavily formatted in prescribed (often complex) terms. They tie back to HS codes, and are quite specific.

You’ll also need to properly fill out the B3 Form, which is an accounting document used for paying duties and taxes. Required to be included are any licenses, permits or certificates along with the B3 form. You will also need to provide a packing list (contents, weight, total number of packages) per shipment.

There are some basic requirements to be met in order to capitalize on lower rates of duty normally paid to imported goods. These are achieved through free trade agreements and dictate the declared tariff treatment and classification which establish the applicable customs duty rate on goods imported into Canada.

They may be eligible for a tariff treatment based on:

- Rules of origin

- Proof of origin requirements

- Shipping requirements

- A term or condition contained in or made following, an agreement

From the CBSA,

All claims for a preferential tariff treatment must also meet the shipping requirements (such as direct shipment, transit and transhipment) for that tariff treatment. The shipping provisions identify the requirements that the goods must meet while coming to Canada. Ex. all goods have to stay in customs control at all times.

Any delays that are results of incorrect or incomplete forms, including labeling HS codes accurately, proper usage of tariff treatment claims by FTAs can lead to really frustrating logjams when it comes to getting your goods imported into Canada. Chances are, this is just a small piece of your importing puzzle, but it is essential to your bottom line and that of your buyers and vendors. Would you leave your taxes to be done by a gardener? When it comes to perfect paperwork for your importing needs, you’re going to want to talk to a customs broker. Why not make it a free consultation call with an A & A customs broker?

Importing from Canada into the USA:

There are lots of similarities between importing and exporting to and from Canada and the USA, respectively. For importing from Canada from the US, the most important document required from a U.S. exporter is a properly completed Canada Customs Invoice or its equivalent for all commercial shipments imported into Canada. Note that “properly” is emphasized; these documents aren’t a walk in the park and small errors on the clerical front can hit you with expensive delays and penalties, post haste.

Here is a quick checklist of the most crucial documents required in the US Import Entry Process:

- Commercial Invoice (Invoice from seller to buyer)

- Packing List.

- Bill of Lading.

- Entry Manifest (CBP Form 7533) or Application and Special Permit for Immediate Delivery (CBP Form 3461)

- Evidence of Bond.

- Entry Summary (Form 3501)

You may also need a license from local or state authorities to do business. CBP entry forms do ask for your importer number: this is either your IRS business registration number, or if your business is not registered with the IRS or you do not have a business, your social security number will be sufficient. As an alternative, you may request a CBP assigned number by completing a CBP Form 5106 and presenting it to the Entry Branch at a CBP port of entry.

Our CPB (Customs and Border Protection) neighbors in the United States don’t require importers to have a special license or permit, but it’s possible that other agencies may require a permit, license, or other certification, depending on the commodity that is being imported.

Too much paperwork – too little time/patience/certainty?

Are you feeling a bit overwhelmed? Sometimes the best way to manage uncertainty is to have a real time conversation with an expert. Our A & A experts know the laws and documentation you need to ship in and out of Canada/the USA and would be more than happy to chat.

Send us an email or give us a call, 1.800.663.4270. Let’s see how we can help your cross border tax codes, documents and any other deliverables needed to ensure a healthy bottom line, and happy customers, border guards and brands, all at once.

Don’t take our word for it, our friends at the Great Little Box Company help paint a clear picture of why A & A has so many loyal customers, and why we’re seeing a surge in companies looking for a true partner when it comes to their importing and exporting business.

“We find the staff and our account manager to be very knowledgeable, responsive, and proactive in assisting us with our needs. They’ve taken the time to understand our business and logistics and have supported us in numerous ways to ensure that we have the right tariff codes, avoid unnecessary duties, are compliant and streamline our cross-border process to avoid unnecessary delays.” – The Great Little Box Company

A & A, making the border disappear since 1979.